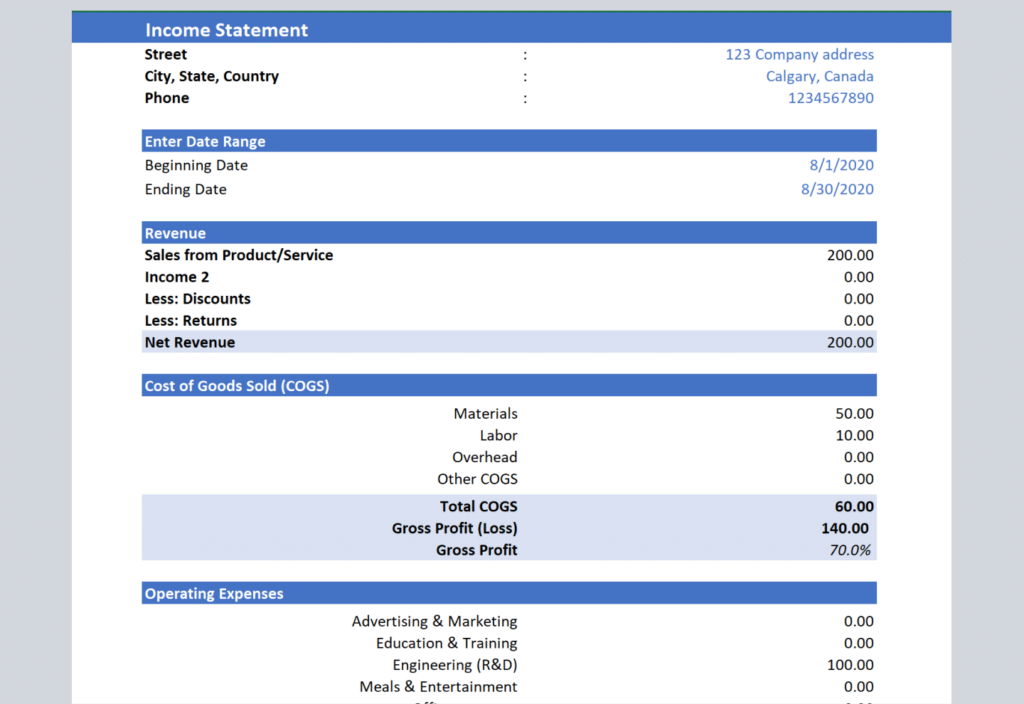

Free income statement template (in excel)

Track your periodic income by using this Excel template

Enter your information below to instantly get access to your free copy

Get more value than income templates.

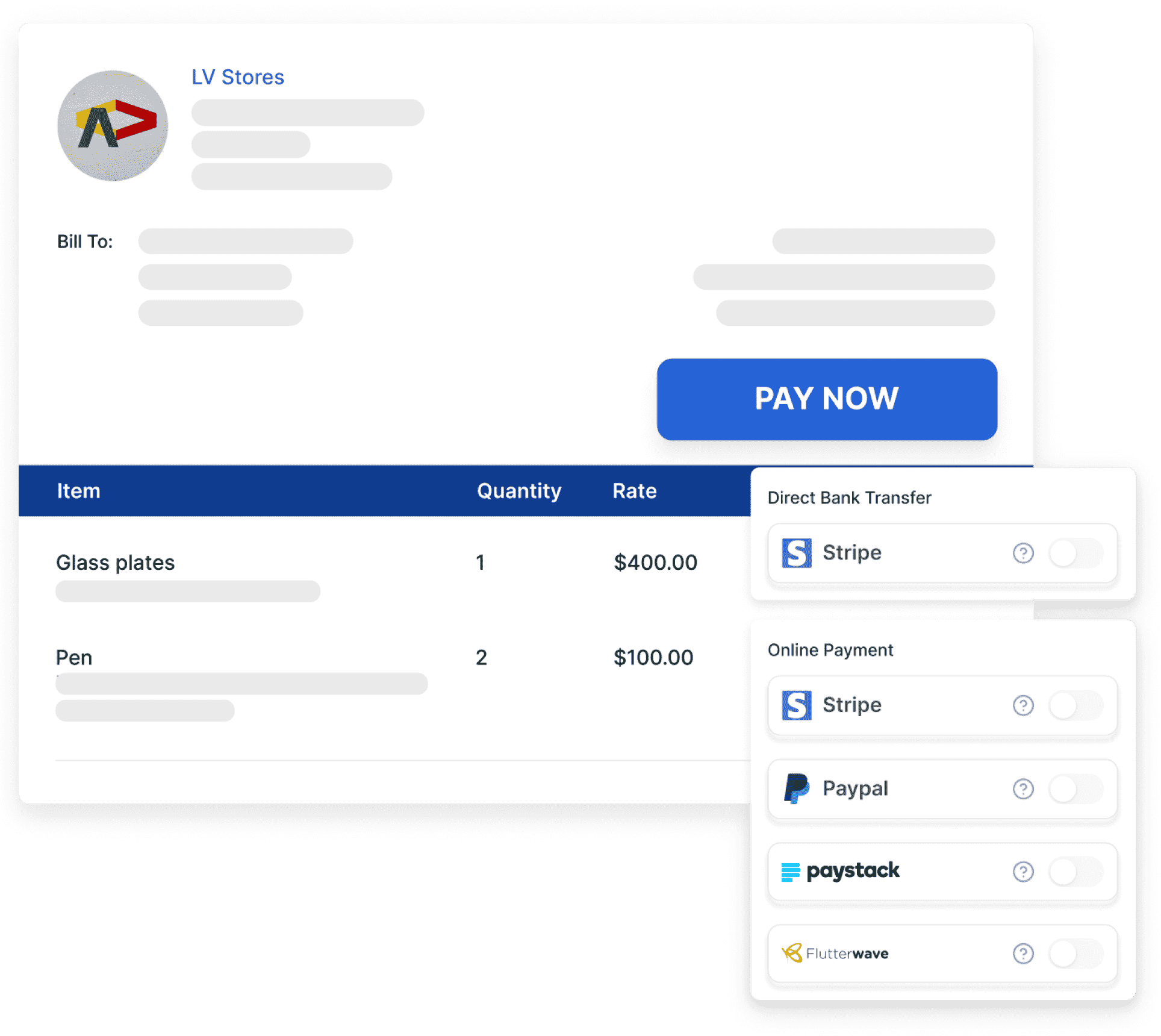

Invoicing

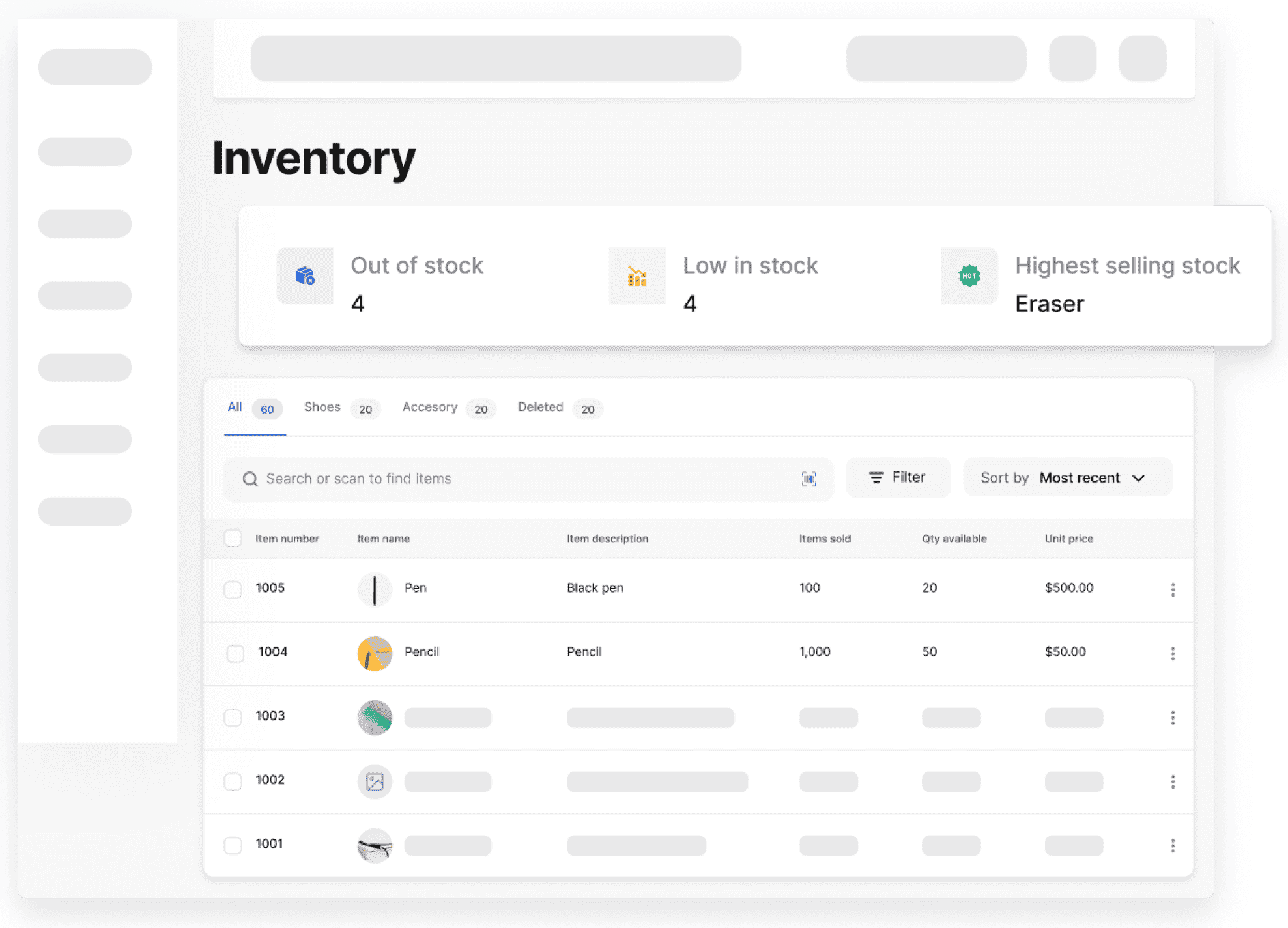

Inventory management

Accounting

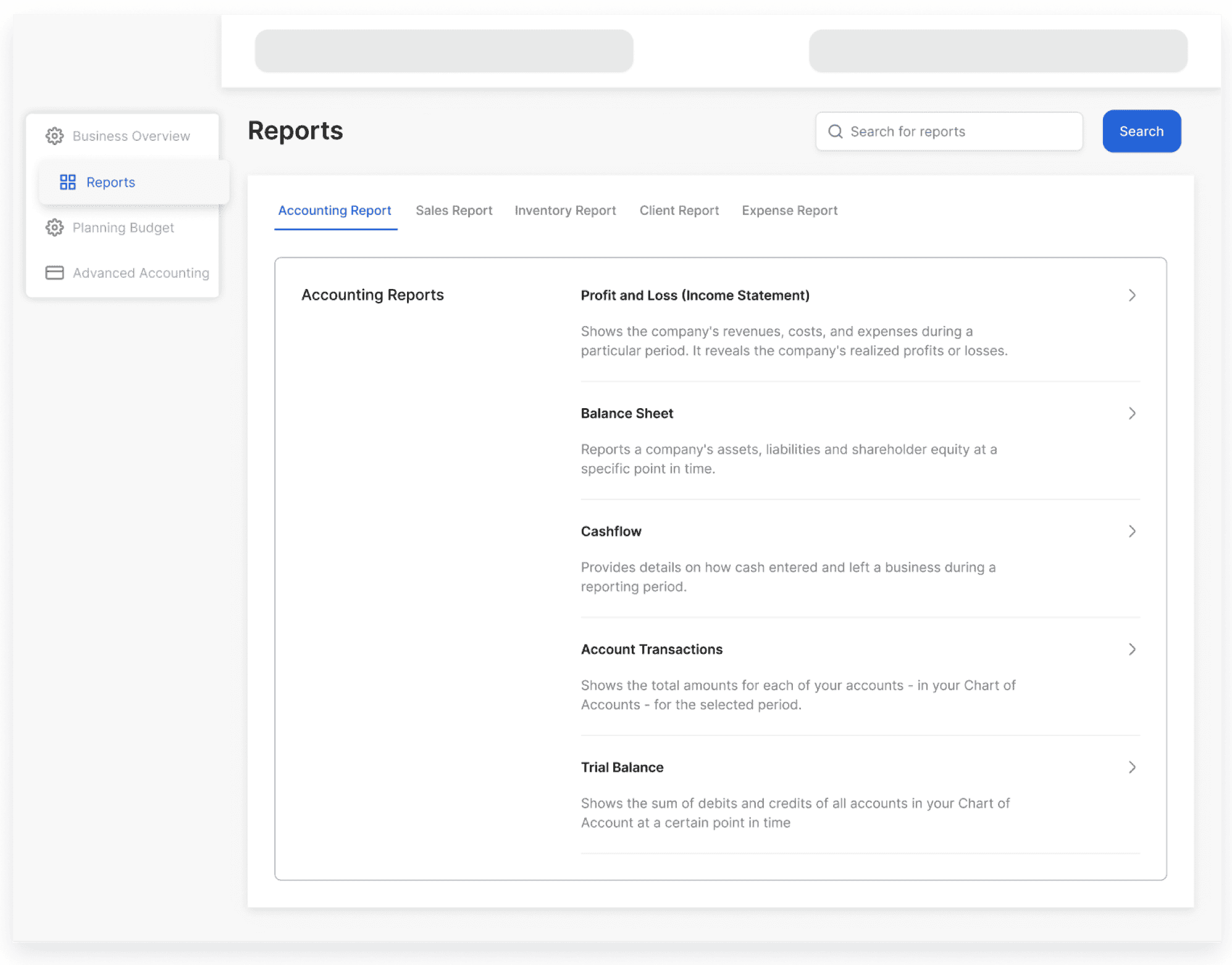

Reporting

Employee management

Payments

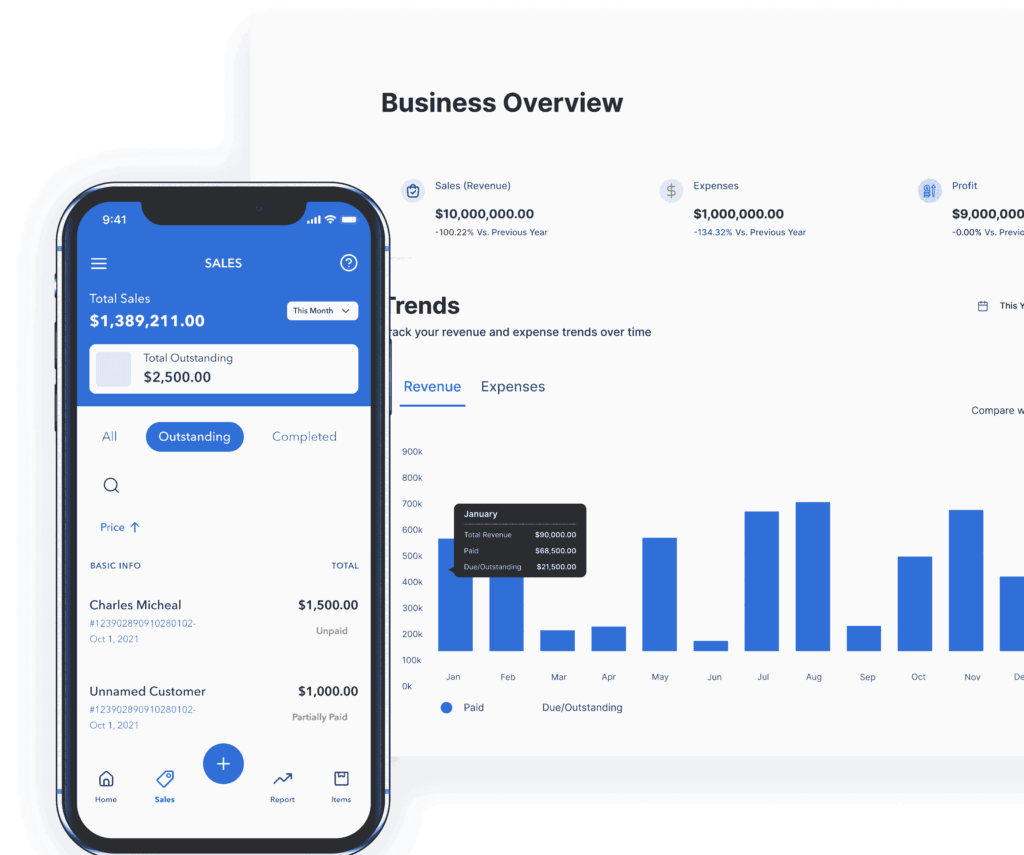

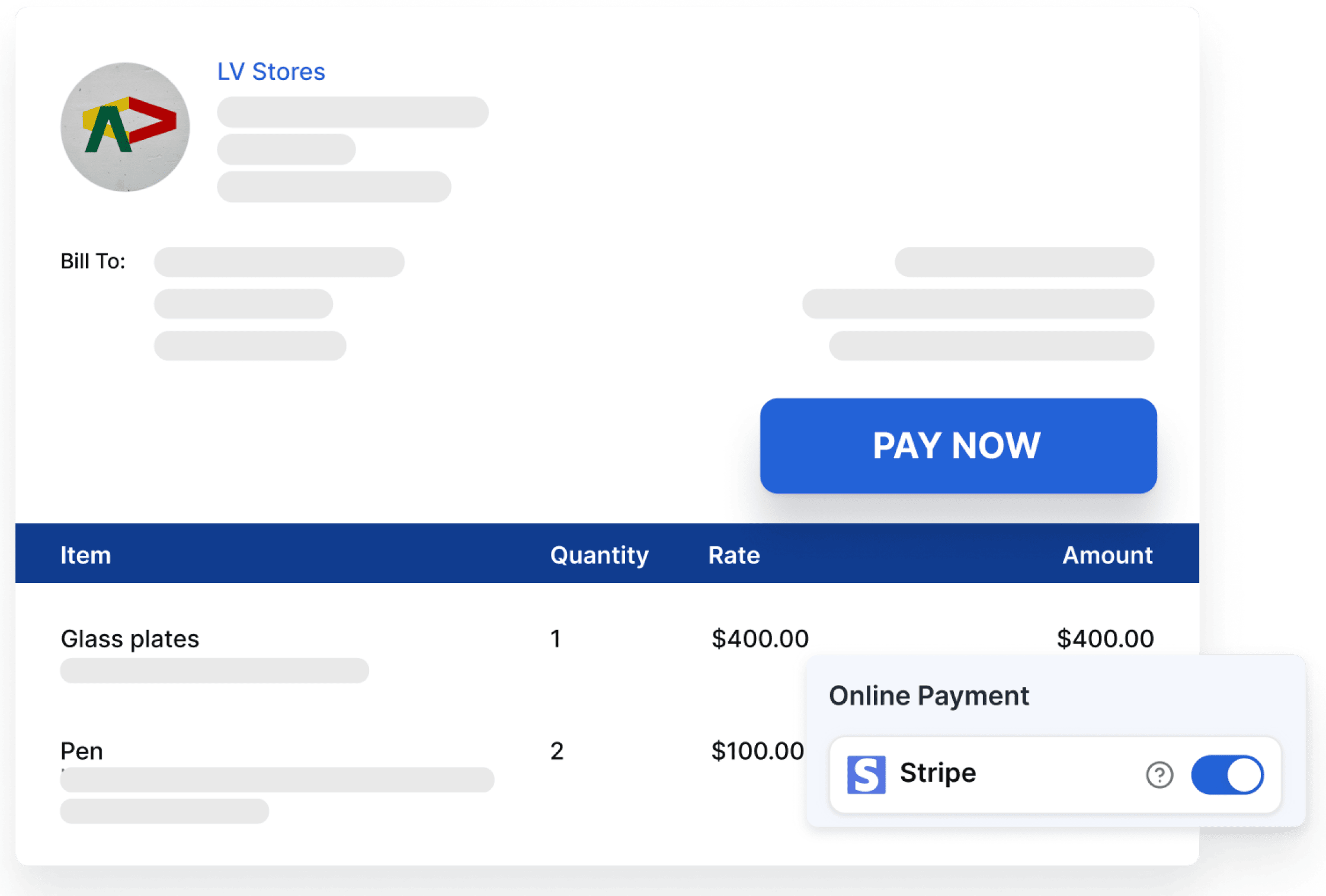

Send invoices and manage debtors

Make business transactions easier and simpler with professional invoices generated through Vencru. Accept online payments. Say goodbye to calculators and get automated updates on paid invoices, pending and overdue.

Automatically track stock levels

Managing an online retail business or a shop with inventory? Vencru has you covered with our inventory management features. You can track your inventory levels, link invoicing to inventory, & perform stock taking. You can also import your product details seamlessly.

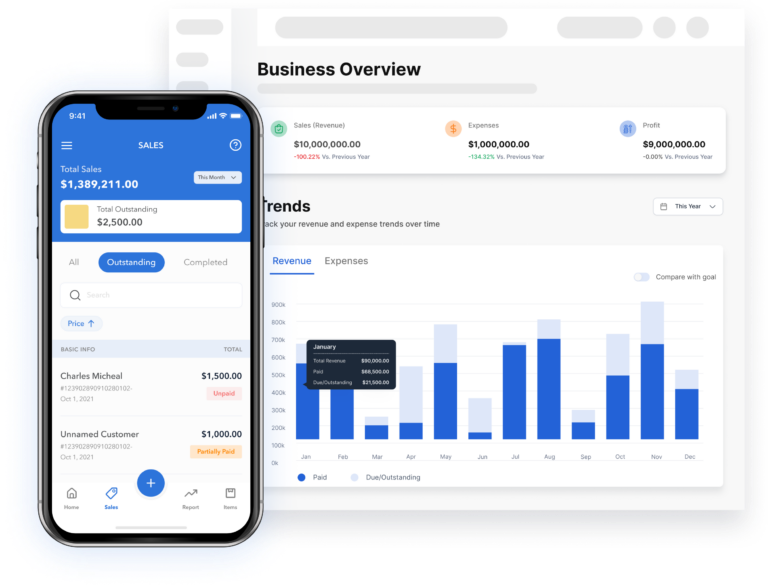

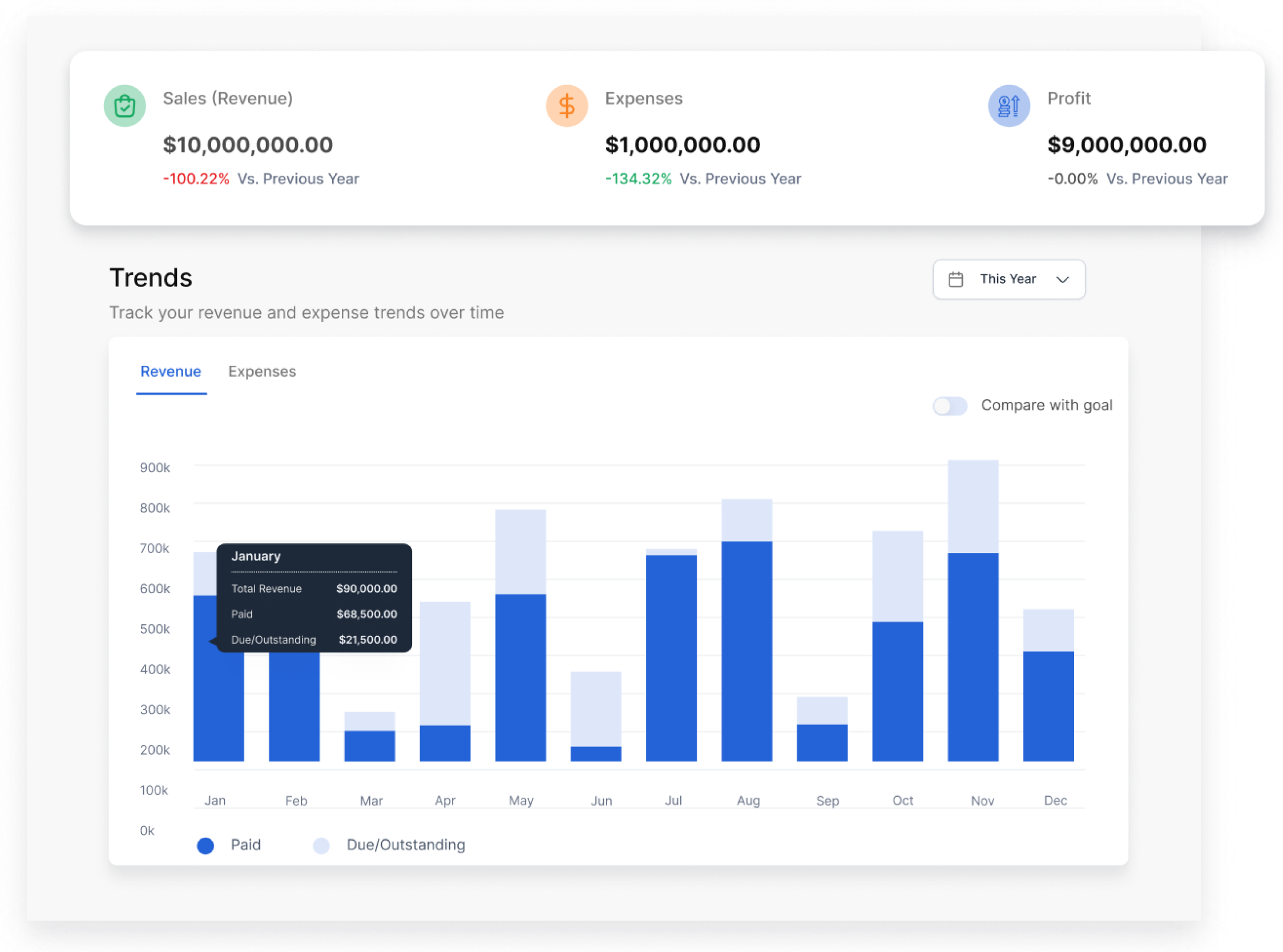

Up to date accounting reports

Reviewing accounting reports does not have to be complex. Track your finances and get accurate double entry accounting reports. You can also collaborate with your accountant at any time.

Easy to understand reports

Generating a daily sales report or income statement should be simple. With Vencru, you can access your accounting reports with just one click. Simple or complex, we simplify into easy reports that you can understand your finances.

Manage employees better

Easily manage your employees, improve team productivity and make better business decisions.

Secure online Payments

Receiving payments from customers does not have to be a hassle anymore. Accept swift and secure online payments or direct bank transfer from customers.

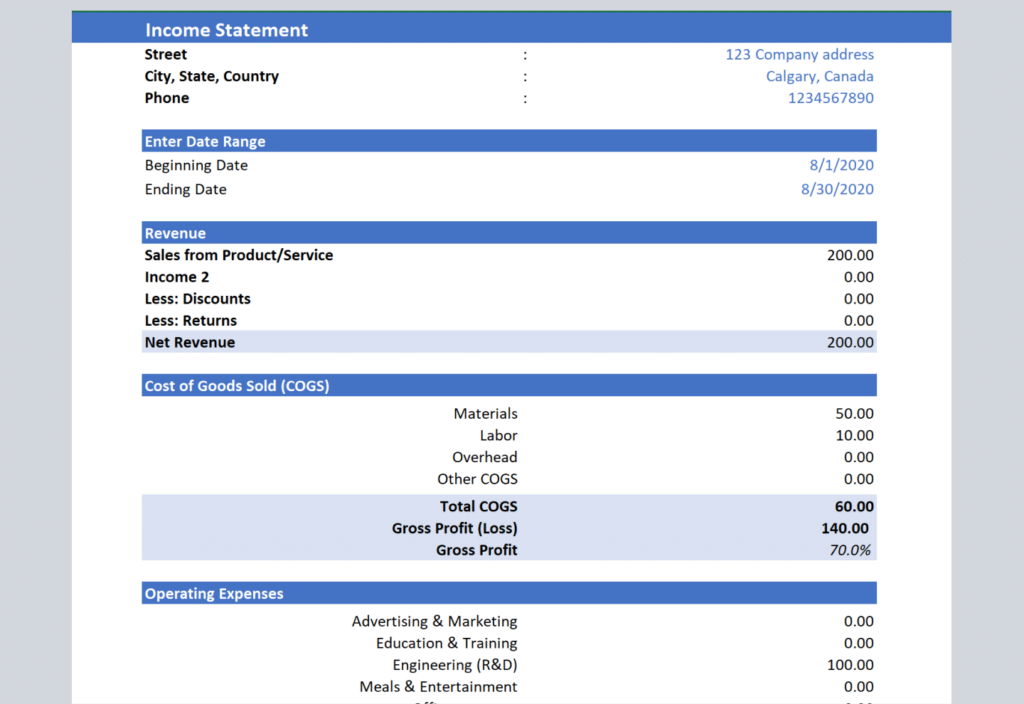

Income Statement Template: A Comprehensive Guide

What is an Income Statement?

An income statement, also known as a profit and loss statement, is a financial document that provides a summary of a company’s revenues, expenses, and profits over a specific period. It showcases the company’s financial performance and profitability, making it a crucial tool for business owners, investors, and stakeholders.

An income statement is an accounting report that tells you whether your business is profitable and how much profits you’ve made over a period, say, one year. It contains detailed information about your revenue, your expenses, and your net profit–that is, your profit after all expenses. An income statement is also known as a profit and loss statement.

The income statement is one of the most important reports in every business, and it’s one that every business owner must fill. The report provides information about your company’s ability to generate profits, and it can help you raise more funds for your next business year if you need to.

Why is an Income Statement Important?

The income statement offers valuable insights into a company’s financial health and performance. It allows businesses to assess their revenue generation, expense management, and overall profitability. For investors, the income statement aids in making informed decisions about potential investments.

Income statements are useful for understanding the financial performance of your business. When you know that your brand is raking in more profits, you’re confident to approach the next business year with even bigger goals.

Also, income statements help you compare your business profits over time, by showing your changes in revenue and spending. The income statement can tell you if your expenses are growing faster than your income, causing you to make less profit than you made in the past year. With this insight, you can make moves to cut down your spending while keeping your revenue high.

Which Accounts are Found on an Income Statement?

The income statement typically includes key accounts such as:

- Revenues: Total income generated from sales or services rendered.

- Cost of Goods Sold (COGS): Direct costs associated with producing goods or providing services.

- Gross Profit: The difference between revenues and COGS. It represents the company’s core profitability.

- Operating Expenses: Indirect costs related to the day-to-day operations of the business.

- Operating Income: The result of subtracting operating expenses from gross profit.

- Other Income and Expenses: Miscellaneous items that impact net income, such as interest income and expenses.

- Net Income: The final figure after accounting for all revenues, expenses, gains, and losses.

How do I Prepare an Income Statement?

To create an income statement, follow these steps:

- Gather Financial Data: Collect revenue, expense, and cost data for the specified period.

- Calculate Revenue: Sum up all sources of revenue, such as sales and service income.

- Calculate COGS: Determine the direct costs related to goods or services sold.

- Calculate Gross Profit: Subtract COGS from total revenue to get the gross profit.

- Deduct Operating Expenses: Account for all operating expenses, including salaries, rent, and utilities.

- Calculate Operating Income: Subtract operating expenses from the gross profit.

- Include Other Income and Expenses: Factor in any non-operating income or expenses.

- Calculate Net Income: Subtract other income and expenses from operating income to arrive at the net income.

How do I Make a Pro Forma Income Statement?

A pro forma income statement is a financial forecast that predicts future earnings and expenses. To create one, follow these steps:

- Analyze Historical Data: Examine past income statements and financial performance.

- Project Revenue: Estimate future sales and revenue based on market trends and business projections.

- Forecast Expenses: Predict upcoming expenses, including COGS and operating expenses.

- Calculate Net Income: Combine projected revenue and expenses to determine the projected net income.

Frequently Asked Questions (FAQs)

Unearned revenue is not included in the income statement until the goods or services are delivered.

Conclusion: Empowering Your Business with the Income Statement Template The income statement template is an invaluable tool that helps businesses gauge their financial performance and make data-driven decisions for growth and success. By understanding its significance and using the right resources, businesses can optimize their financial strategies and thrive in today’s competitive landscape.

Yes, depreciation expense is included in the income statement as an operating expense.

Yes, the income statement is often referred to as the profit and loss statement or P&L statement.

No, accounts receivable are not part of the income statement; they are recorded on the balance sheet.

Dividends are not listed on the income statement; they are paid to shareholders after calculating net income.

Accumulated depreciation is not shown on the income statement but is reflected on the balance sheet.

Yes, the cost of goods sold is an essential component of the income statement.

Net income is calculated by subtracting total expenses, including COGS and operating expenses, from total revenue.

No, accounts receivable are not reported on the income statement but are recorded on the balance sheet.

Retained earnings are not part of the income statement; they are shown on the balance sheet.

Bank statements can serve as proof of income, particularly for self-employed individuals or freelancers.

Yes, a profit and loss (P&L) statement is synonymous with an income statement. It indicates a company’s financial performance.

Work faster with the simplest accounting software

Signup today and manage your bookkeeping on the go. You can send invoices, see sales reports, monitor inventory levels, track expenses, get accounting statements, and more – anytime and anywhere.